BOSTON—Industry experts are grappling with a critical question: Will the Boston Life Sciences real estate market recover, and if so, when? This is the central theme of a new report from Colliers Boston, which highlights ongoing challenges affecting both supply and demand. According to the report, rising vacancies across Boston, Cambridge, and the surrounding suburbs are a growing concern, signaling that a full recovery may be years away.

The Boston area, known for its robust life sciences sector, currently holds the largest construction pipeline in the nation. However, this expansion has led to an oversupply of space, exacerbating vacancy rates and contributing to a prolonged market imbalance. The Colliers report suggests that a return to equilibrium could take a considerable amount of time, even under optimistic recovery scenarios.

“Vacancies continue to rise with each passing quarter. The total availability rate of 26.9%—one of the highest in the nation—is 10 percentage points higher than availability one year ago,” says the Colliers report. “New construction was a major contributor to the increased vacant space, adding pressure to an already softened market.”

Key Takeaways from the Report:

-

Increased Vacancy: In the fourth quarter of 2024 alone, over one million square feet of space were delivered to the market, much of it remaining empty. This surge in new supply further amplified the already-high vacancy rates.

-

Negative Net Absorption: For the first time in more than a decade, the Boston life sciences market saw negative net absorption during the fourth quarter of 2024, pulling the annual total into the red. This marks a significant shift, as demand for space has not kept pace with the increasing supply.

-

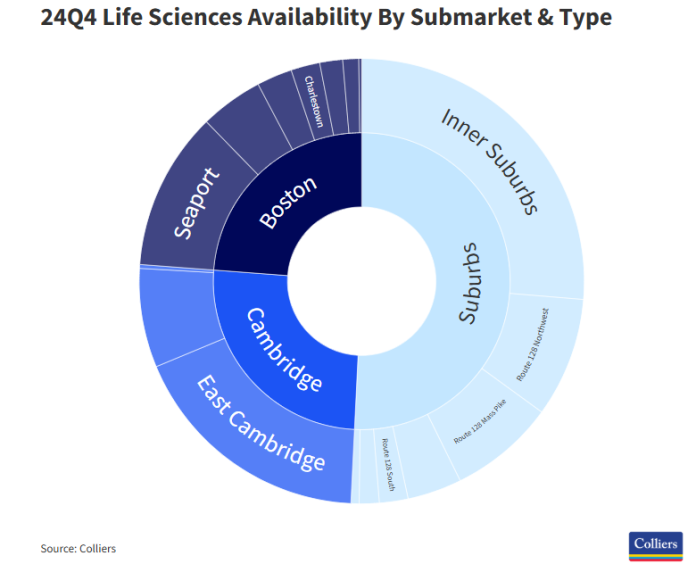

Surplus of Available Space: Currently, there are over 15 million square feet of available life sciences space in the Boston area, a concerning figure for landlords and developers.

Despite these short-term challenges, the report remains optimistic about Boston’s long-term prospects. “Boston’s strong life sciences ecosystem will generate demand in the future,” it states. “However, even under optimistic recovery scenarios, it could take years for the market to return to equilibrium.”

The Impact of Macroeconomic Factors:

The report also notes that broader macroeconomic trends are likely to continue constraining absorption in the near term. The life sciences sector is being impacted by depressed company valuations, which are limiting initial public offerings (IPOs), reducing venture capital flows, and dampening the formation of new companies.

In 2024, venture capital investments in the Boston area declined for the third consecutive year, while only seven companies went public. These factors, combined with high interest rates, have caused many life sciences firms to scale back their expansion plans, lay off workers, and, in some cases, close their doors altogether.

“Companies are adjusting to a more challenging economic environment, limiting their growth potential and reducing demand for office and lab space,” the report explains. “This slowdown in new business formation and expansion further complicates the outlook for the real estate market.”

Looking Ahead:

While the short-term outlook for Boston’s life sciences real estate market remains subdued, the report underscores the importance of Boston’s life sciences ecosystem as a long-term driver of demand. The city’s established reputation as a hub for innovation, research, and development in the life sciences space provides a foundation for future recovery. However, industry stakeholders will need to weather a period of market volatility and shifting dynamics before the market stabilizes.

In conclusion, while there is optimism about Boston’s future as a life sciences powerhouse, the road to recovery in the real estate market will likely be long and unpredictable. It may take several years for the market to return to a healthy equilibrium, especially given the current economic and industry-specific headwinds.