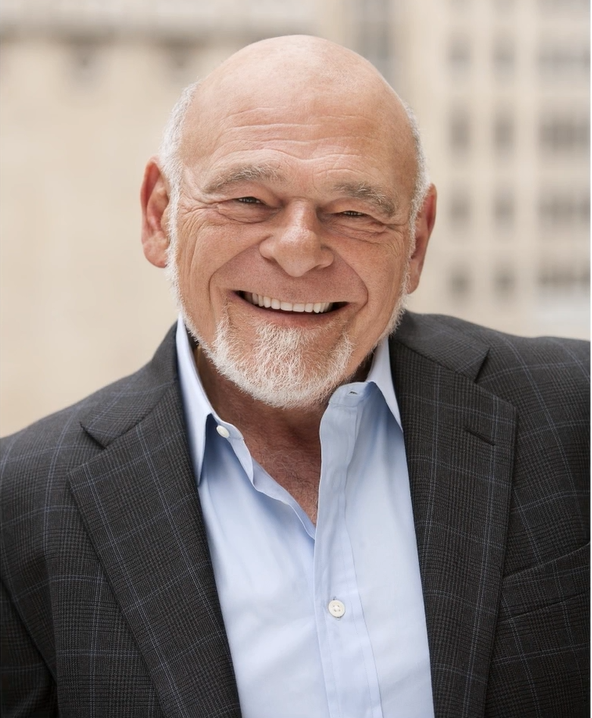

BOSTON–In times of disruption, the most valuable insights often come not from forecasts, but from first principles. Few business leaders embodied that mindset better than Sam Zell, the legendary investor known for his contrarian thinking, sharp wit, and relentless focus on capital discipline.

Although the following imagined interview—originally published in Boston Real Estate Times—is framed around real estate, its lessons extend far beyond any single asset class. At its core, this is a conversation about how businesses survive cycles, manage risk, and position themselves for opportunity when the environment turns unforgiving.

Zell built his reputation by understanding a simple but often ignored truth: markets don’t usually fail because of bad ideas—they fail because of bad capital structures. Leverage taken for granted. Liquidity dismissed as unproductive. Growth pursued without margin for error. When conditions change, those weaknesses are exposed quickly.

That dynamic is not unique to real estate. It applies equally to entrepreneurs, operators, founders, investors, and executives navigating today’s volatile landscape—whether in technology, manufacturing, healthcare, finance, or media. The discipline Zell preached—stay solvent, preserve optionality, and respect uncertainty—is universal.

This imagined AI conversation revisits Zell’s thinking in the context of today’s market reset: declining valuations, tighter capital, structural change, and widespread denial. His answers challenge easy narratives and redirect attention to what truly matters—balance sheets, timing, humility, and survival.

For anyone leading a business through uncertainty, this is less an interview about property and more a masterclass in capital awareness.

Read the Full Original Article

What Would Sam Zell Say Today?: Survival, Solvency, and Opportunity in a New Real Estate Market

Originally published by Boston Real Estate Times (December 13, 2025)